Sustainable Development

What is Sustainable Development?

Sustainable development means meeting the needs of the present without limiting the needs of the future.

Signs of Sustainable Development

In addition to economic development, the efficient use of natural resources and the focus on health and social issues are signs of sustainable development.

Sustainable Development Goals

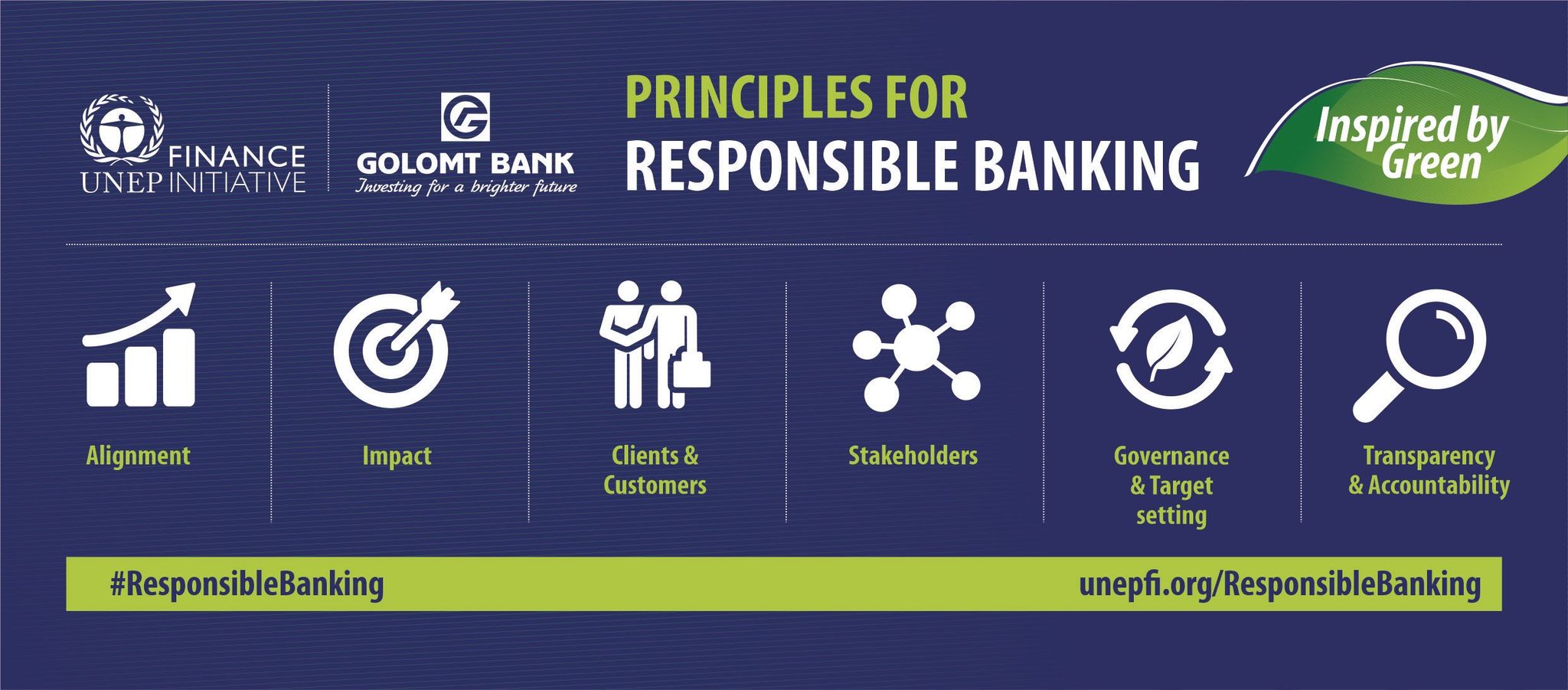

Golomt Bank on September 22, 2019 in New York, USA, became one of the Founding Signatories of the Principles for Responsible Banking, committing to align strategically its business with the Sustainable Development Goals and the Paris Agreement on Climate Change.

Golomt Bank, by signing the Principles for Responsible Banking, joins a coalition of 130 banks worldwide, representing over USD 47 trillion in assets, in committing to taking on a crucial role in helping to achieve a sustainable future.

- Golomt Bank updated its “Sustainable Development Policy”

Golomt Bank has updated its “Sustainable Financing Policy” to “Sustainable Development Policy”. In doing so, Golomt Bank will instill implement the “Sustainable Development Goals” of the United Nations in all its operation supporting environmental and social friendliness, while adhering to the principles of sustainable financing to lending activities. Within the framework of this policy, Golomt Bank has also implemented the initiatives to reduce energy, water and paper consumption in its daily activities, improve waste management, sort and recycle waste, increase the number of special roads for wheelchair users in branch offices, and cooperate with environmentally friendly organizations. We are also working to support suppliers who produce environment-friendly products and aiming to organize training programs on Sustainable Development for our suppliers.

- Environmental and Social Risk Assessment in the lending activities of the Golomt Bank

Golomt Bank, in 2015, introduced Sustainable Financing Policy and environmental and social risk assessment procedures into its lending activities.

Golomt Bank, in 2019, has revised its principles regarding environmental and social risk management and mitigation of environmental and social impacts in its “Credit Policy”. As a result, business loans that meet the following minimum features are required to have environmental and social (E&S) risk assessment.

• All loan applications included in the list of activities to be considered in the Sustainable Finance Principles of Mongolia

• Business loan applications of high-risk sectors of E&S as outlined in the Mongolian Sustainable Finance Principles. These sectors include mining, energy, construction, forestry, agriculture, manufacture, and chemicals /trade, use and process/

• Other business loan requests more than MNT 50 million or more than 12 months tenor.

- IFC's green finance capacity building consulting service has been successfully completed

From September 2018 to June 2019, Golomt Bank successfully implemented a /энэ а article-ыг авах/ green finance capacity building program in cooperation with IFC. Under this program, Golomt Bank’s employees received training on green business opportunities identification, green project technical assessment and risk analysis, and energy efficiency calculations to increase their knowledge of green finance. In addition, Golomt Bank highlights the sectors in high demand for green finance as reflected in Mongolia's “Nationally Determined Contribution” and aims to support customers in the energy saving, green building, and sustainable cashmere textile sectors.

- Golomt Bank established the “Gender Equality Committee”

In 2018, Golomt Bank began implementing our “Gender Equality Policy” the primary goal was to ensure equal representation and compensation for all staff in regards to workplace communication, decision making and operations.

This policy has enhanced corporate culture through improving information sharing, lowering gender biases, increased responsibility at all levels.

Career development and promotion opportunities for women employees are fully open to Golomt Bank, and the bank pays special attention to this issue. For instance, in the case of personnel at leadership positions of the bank was 69% are female, and the number of positions and careers for female employees have increased by 4-5% over the past two years.

Golomt Bank not only strives to support gender equality at the workplace with initiatives in place, but we have also been supporting gender equality among our customers through improved access to financial products and services in order to support their business enterprises. Therefore, Golomt Bank aims to make financial services more accessible and advanced for women, to turn what women can do into businesses for profit, to provide financial support, to ensure gender equality, to make women's voices heard, and to promote actively social welfare. As part of this initiative, we have established the “Gender Equality Committee” in 2020.

- Golomt Bank updated its “Sustainable Development Policy”

- Mongolian Sustainable Finance Association (MSFA)

Golomt Bank has been a major member of MSFA since its initiation, supporting and voluntarily implementing the 8 Principles of Sustainable Finance of Mongolia. In addition, the management team member of Golomt Bank, is elected to the Board of Directors of MSFA and has contributed to the improvement of the Association's operations and governance. Golomt Bank actively participates in projects, programs and trainings organized by MSFA and builds its sustainable financing capacity and implements them in own operations.

- United Nations Environmental Program Financial Initiative (UNEP FI)

In September 2019, Golomt Bank officially adopted the “Principles of Responsible Banking” issued by UNEP FI, contributing to climate change actions and supporting the Paris Agreement and Sustainable Development Goals of UN. Golomt Bank first joined the UNEP FI Banking Committee in 2017, is one of the 30 founding members of the “Principles of Responsible Banking”. Currently, 197 banks around the world have joined the Principles and are working together to develop a plan on how to implement and report on these Principles. In 2020, Golomt Bank worked as a member of “Climate Change Cooperation” working group to study how to measure, calculate and reduce the climate impacts of the bank's loan portfolio. From 2021, the banks incorporated in the Principles will begin to implement and report on the principles in accordance with their plans.

- Collective Commitment to Climate Action (CCCA)

In September 2019, 38 voluntary banks, which joined the United Nations Responsible Banking Principles, signed the joint commitment on actions against climate change. Golomt Bank is one of these 38 banks, and joined this initiative to fulfill its commitment to keep global warming at 2 degrees Celsius and to contribute to the transition to a net zero economy on behalf of the banking sector. On December 8th of 2020, the UNEP FI released a collective report about the first year work of CCCA banks, highlighting Golomt Bank's updated environmental and social risk management system.

- Mongolian Sustainable Finance Association (MSFA)

This website uses google analytics

This website uses information gathering tool which is Google analytic in order to determine the effectiveness of our online campaign in terms of sales and user activity on our sites.